Applying for a Chase Personal Loan is a practical way to handle expenses such as debt consolidation, home improvements, or major purchases.

This guide explains how the process works, who qualifies, and what to expect during application.

Chase remains one of the most trusted banks in the United States, offering reliable and secure loan services. Knowing each step helps you apply efficiently and make informed financial decisions.

Understanding Chase Personal Loans

Chase offers personal loans to existing customers who want fixed payments and predictable terms. It provides flexible amounts that can fit different financial goals.

You can apply directly through your Chase Online or Mobile Banking account. The funds are deposited quickly once approved.

The process is straightforward and built to ensure you receive support every step of the way.

Loan Features and Purposes

Chase Personal Loans are designed for multiple purposes that benefit your financial situation. These include:

- Debt Consolidation – Combine multiple debts into one manageable payment.

- Home Improvement – Fund necessary renovations or home upgrades.

- Emergency Expenses – Cover unexpected costs without using credit cards.

- Major Purchases – Finance large purchases with structured repayment terms.

Each purpose allows flexibility without the need for collateral, making the loan unsecured and easy to access.

Benefits of Choosing a Chase Personal Loan

Chase Personal Loans offer multiple advantages for borrowers seeking financial stability. The bank’s long-standing reputation provides security and trust.

With predictable rates and a streamlined digital process, you can manage your loan entirely online. It also integrates smoothly with other Chase Bank services for convenience.

Key Advantages

These main advantages make a Chase Personal Loan a dependable choice for borrowers who want predictable payments, transparent terms, and fast access to funds.

- Fixed Interest Rates – Your monthly payments stay the same throughout the loan term.

- No Hidden Fees – Chase does not charge origination or prepayment fees.

- Quick Funding – Approved loans are typically funded within one to three business days.

Flexible Terms

You can borrow amounts from $2,000 to $50,000, depending on eligibility. Loan terms usually range from 12 to 60 months, allowing manageable repayment schedules.

These options make Chase loans suitable for various financial needs across the United States.

Eligibility Criteria

Before applying, you need to confirm that you meet Chase’s requirements. The bank primarily serves existing customers, so having a Chase account is essential.

You’ll also need to prove stable income and creditworthiness to qualify. Being prepared with documentation speeds up approval.

Basic Requirements

Here are the basic qualifications you must meet before applying for a Chase Personal Loan.

- You must be at least 18 years old and reside in the United States.

- You must have a steady source of income.

- A good credit history is required for better loan terms.

Required Documents

Prepare these documents before applying to speed up your Chase Personal Loan approval.

- Valid government ID (driver’s license or passport).

- Proof of income such as recent pay stubs or tax returns.

- Bank account and contact information for verification.

Providing accurate and updated information helps avoid delays during processing.

Interest Rates and Terms

Interest rates vary based on your credit score, loan amount, and repayment term. Chase offers competitive fixed rates, ensuring predictable payments throughout the loan’s life.

Rates generally range between 7.49% to 24.99% APR, though they can change depending on market conditions. The better your credit, the lower your rate will be.

For example, a $10,000 loan with a 10% APR for 36 months would result in an estimated monthly payment of about $323.

Chase allows borrowers to choose shorter or longer terms depending on financial capacity. Using the online calculator helps estimate your monthly obligations accurately.

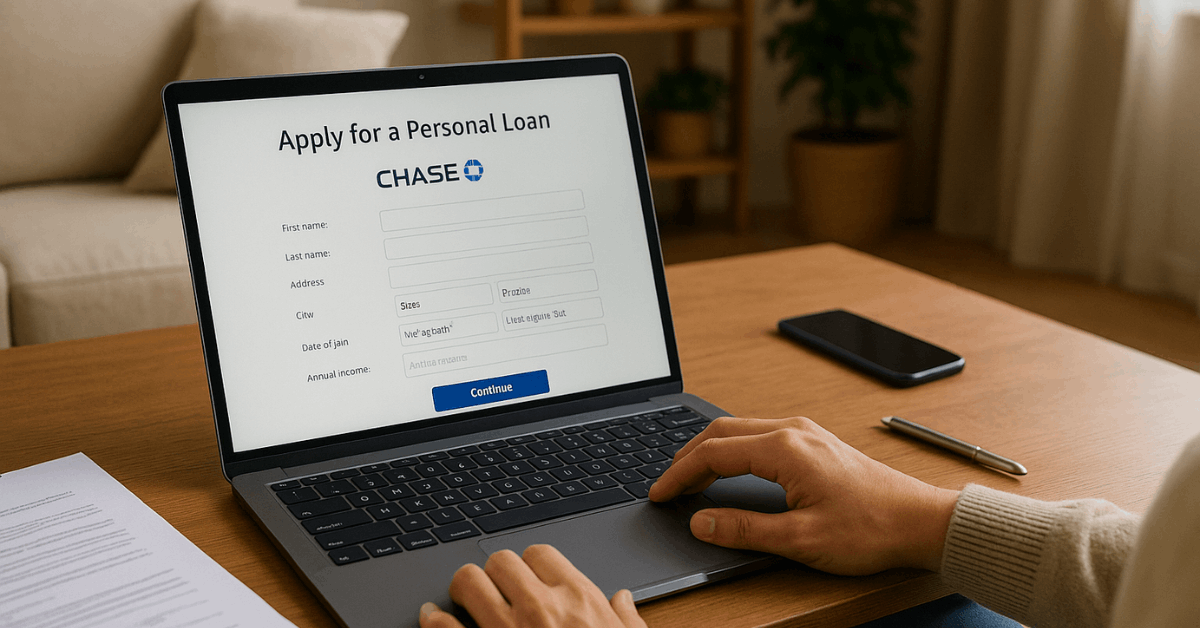

Step-By-Step Application Process

The Chase Personal Loan process is digital and simple. It ensures applicants can complete every step without visiting a branch. Below is the step-by-step process you can follow for a smooth experience.

1. Log In to Your Chase Account

Start by signing in to your Chase Online or Mobile App. Navigate to the “Loans” or “Personal Loans” section and choose “Apply Now.”

2. Check for Prequalified Offers

You may see prequalified loan options that do not affect your credit score. These offers are based on your current relationship with Chase.

3. Complete the Online Form

Fill out personal, financial, and employment details. Select your desired loan amount and repayment term carefully to match your budget.

4. Upload Supporting Documents

Attach your ID, proof of income, and banking details. Chase may verify your employment or contact you if further information is needed.

5. Review and Confirm Loan Terms

Read through the loan agreement carefully. Check the interest rate, payment amount, and schedule before proceeding.

6. Wait for the Loan Decision

After submission, Chase will evaluate your application. You can typically expect a decision within one to three business days.

7. Accept and Receive Funds

Once approved, the loan amount will be directly deposited into your Chase checking account. You can start using the funds immediately.

Repayment Options

Once your loan is approved, repayment starts based on your agreed schedule. Chase provides multiple repayment methods for convenience.

Setting up automatic payments ensures timely deductions and may even qualify you for a small rate discount.

Automatic Payments

AutoPay allows Chase to deduct payments from your account on the due date automatically. It prevents missed payments and helps build a positive payment history.

Manual Payments

You can also make manual payments via Chase Online, the Mobile App, or by visiting a local branch. This flexibility allows you to manage cash flow effectively.

Early Repayment

There are no prepayment penalties. Paying off your loan early helps you save on interest and close your account sooner.

Tips for a Successful Application

Understanding what improves your chances of approval is important. Preparation can make your application smoother and reduce the risk of rejection. Here are some tips to help you qualify efficiently.

- Maintain Good Credit – Keep your credit score healthy by paying other debts on time.

- Avoid Multiple Applications – Too many loan requests can affect your credit score.

- Borrow Responsibly – Apply only for the amount you truly need to manage debt effectively.

- Review All Details – Double-check the form before submission to ensure accuracy.

These steps make the process faster and improve your likelihood of approval.

Comparing Chase Personal Loans with Other Lenders

Understanding how other banks operate helps you decide whether Chase is your best option. Each lender has unique features that may suit different borrowers.

Why Choose Chase?

Here’s why many borrowers prefer Chase Personal Loans over other lenders.

- Trusted U.S. bank with long-standing customer support.

- Seamless integration with existing Chase checking and savings accounts.

- Transparent repayment policies and fixed rates.

Consider Other Options

Here are other lenders you can compare before choosing a Chase Personal Loan.

- SoFi – Offers lower rates for borrowers with excellent credit.

- Discover – Provides flexible loan terms and direct debt payment options.

- Wells Fargo – Available for both existing and new customers.

Comparing lenders allows you to find the best rates and repayment structure for your goals.

Contact Information

If you need assistance during the loan process, you can reach out to Chase through the following official contact channels:

- Customer Service (U.S.): 1-800-935-9935

- Mailing Address: JPMorgan Chase Bank, N.A., P.O. Box 182051, Columbus, OH 43218

- Official Website

These resources provide updates on application status, rate adjustments, and general account inquiries.

Final Thoughts: A Reliable Path to Financial Flexibility

Chase Personal Loans provide security, flexibility, and ease for borrowers who want predictable financing. Its digital tools make applying, managing, and repaying loans simple.

By meeting the eligibility requirements and submitting complete documents, you can get approval quickly and use the funds responsibly.

Whether consolidating debt or funding a project, Chase offers a trusted solution for borrowers across the United States.

Disclaimer

Information in this article may change over time. Please visit the official Chase website for the most updated details. This content is for educational purposes only.