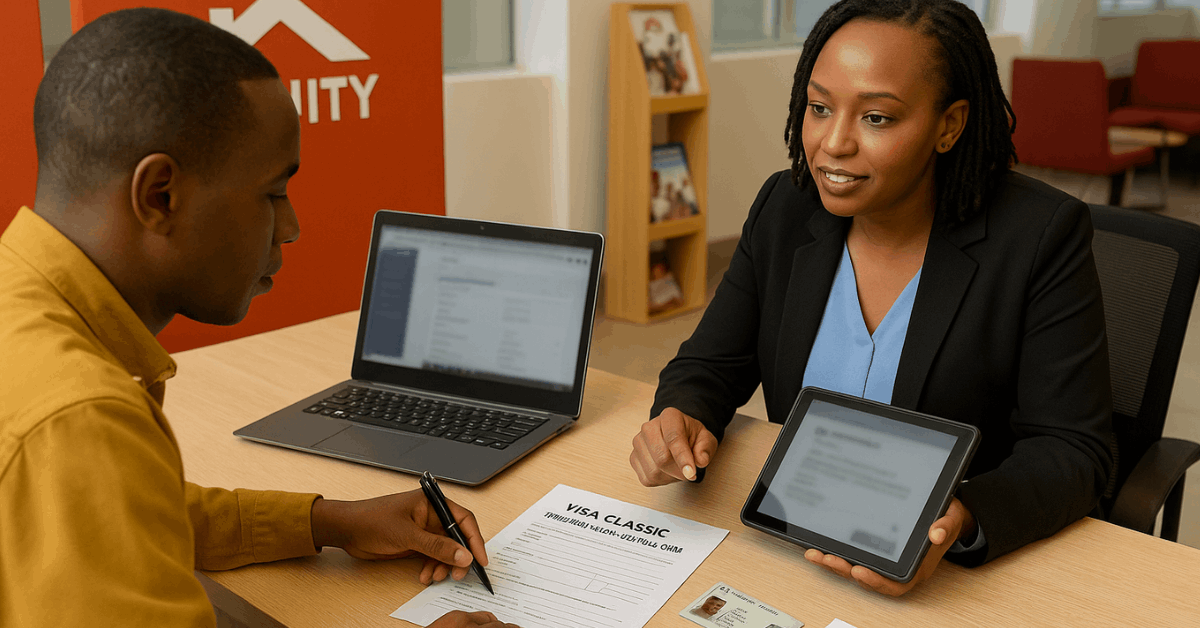

Equity Bank Visa Credit Card – How to Apply

In Kenya and neighboring markets, the Equity Bank Visa Credit Card targets everyday spending, online purchases, and regional travel through wide Visa acceptance and chip-and-PIN security. The Equity Bank Visa Credit Card includes an interest-free window on new purchases when the statement is cleared on time, plus benefits that scale from Classic to Gold and, … Read more