In the UAE’s app-first market, the Liv Bank Credit Card targets quick digital onboarding, flexible rewards, and practical lifestyle perks that fit everyday spending.

Applicants choose between Cashback and Cashback+ variants, switch rewards to Emirates Skywards Miles when travel spikes, and manage everything in the Liv X app without paper shuffling or branch visits.

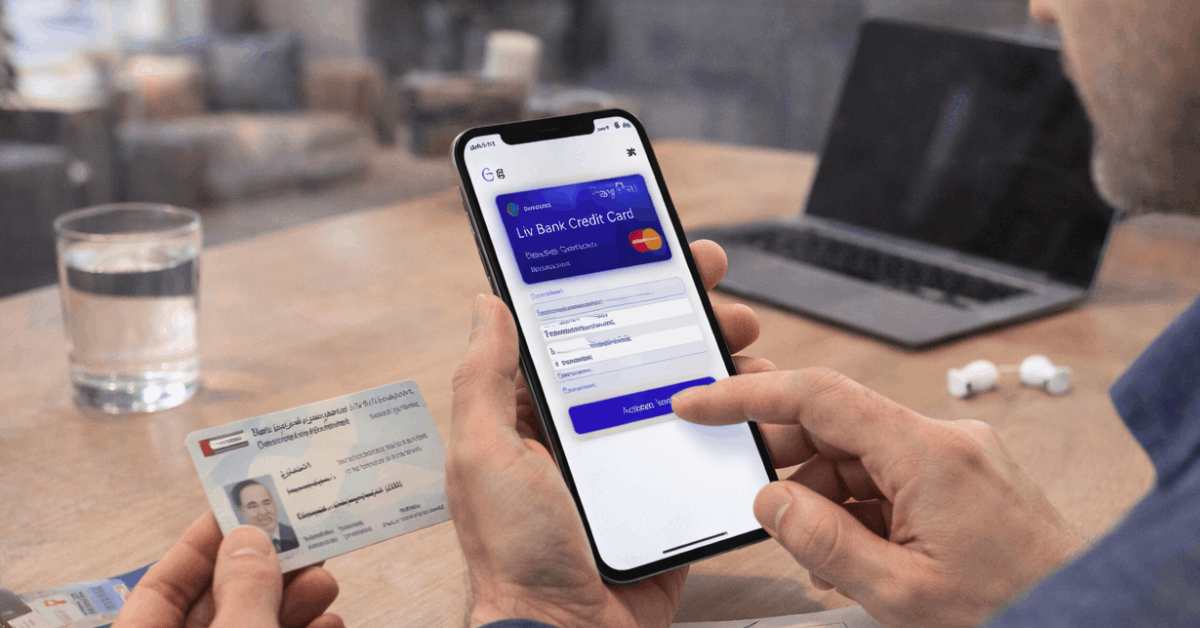

Card controls, statements, repayments, and reward switching live inside the app for less friction day to day. Applicants who meet age and income thresholds can finish the process in minutes and start using a virtual card while waiting for physical delivery.

What The Liv Bank Credit Card Is

Liv positions its cards as simple, flexible tools that earn a flat rate on wide categories, redeem instantly as cashback or Emirates Skywards Miles, and layer lifestyle offers that matter in the UAE.

Reward switching happens in-app without requesting a new plastic, so the same card adapts to a grocery month or a travel month.

Instant approval language applies to in-app applications that pass automated checks, while the card remains subject to standard affordability and compliance reviews. Because Liv operates as a UAE digital bank under the Emirates NBD umbrella, regulatory and operational coverage aligns to local standards.

Eligibility and Documents

Clear criteria save time and reduce back-and-forth during verification. Liv lists a minimum age, minimum salary for the salary-based route, and standard risk controls such as an AECB credit score and a sub-50 percent debt burden ratio.

Internal bank policies still apply, so edge cases can be declined even when baseline requirements appear met. Preparing the right documents speeds up checks and protects against mismatches across ID, residency, and income evidence.

Eligibility Requirements

Applicants must be at least 21 years old and typically need a monthly salary of AED 5,000 or higher for the salary-based route.

AECB credit score and debt burden ratio thresholds apply, and staying below a 50 percent ratio is a recurring condition across UAE issuers.

Sanctions screening and politically exposed person rules also apply, which can affect eligibility for some nationalities and roles.

Documents and Checks

Standard reviews rely on Emirates ID, passport, and valid UAE residency evidence alongside salary proof such as recent payslips or bank statements.

Name order, ID numbers, and employer data should align exactly across documents to avoid manual holds. App-enabled eKYC can shorten the process, but operations may request additional proof if employment is new or income fluctuates seasonally.

Common Rejection Triggers

Mismatched identity details, unreported obligations that spike the debt burden ratio, and recent delinquencies are common blockers.

Applications may also pause when employment cannot be verified through standard channels or when internal policies flag unusual account activity elsewhere in the banking group.

How To Apply Online In The Liv X App

Fast approval depends on clean data entry and consistent records. Plan ten minutes for the full flow, keep your ID on hand, and verify employer and income details match recent statements.

Applicants who meet policy thresholds typically see a decision in minutes, while manual reviews add time for edge cases.

- Download and open the Liv X app.

- Tap the Products tab and select Credit Card.

- Choose Cashback or Cashback+, then tap Apply Now.

- Enter personal details, employment information, and delivery address; upload any requested proofs.

- Review terms, submit, and watch for in-app status updates; activate the virtual card once issued.

Secured Option: Fixed Deposit Credit Card

Applicants without qualifying salary can set up a fixed deposit credit card by creating a fixed deposit inside the app and securing the card against it.

Credit limit typically tracks the pledged amount, and premature liquidation can trigger limit reduction or closure.

This route helps new-to-credit residents, self-employed workers without payroll transfer, and those rebuilding after missed payments start safely. Fixed deposits can be created and monitored inside the same app for a single workflow across savings and card.

Rewards and Perks Snapshot

Flat-rate cashback keeps things predictable, while switching to Emirates Skywards Miles helps when travel plans emerge.

Partner offers change periodically, so verify current terms in-app before purchases that rely on a benefit. Caps apply monthly; aim to align large payments to a single month to qualify for the higher tier on all that month’s spends.

| Feature | Liv Cashback+ | Liv Cashback |

| Base Earn Structure | Flat-rate earn on wide categories | Flat-rate earn on wide categories |

| Reward Options | Cashback or Emirates Skywards Miles | Cashback or Emirates Skywards Miles |

| Lifestyle Perks | Broader partner bundle including airport lounge access | Selected partner perks |

| Redemption | Instant redemption inside the app | Instant redemption inside the app |

| Fees | Annual fee applies on premium tier | Free for Life on entry tier |

Figures reflect published positioning; final rates, caps, and bundles appear in the app and current disclosures.

Fees, Limits, and Interest Basics

Annual fee is free on the entry card and AED 700 on the premium card per the Liv Credit Card Key Facts Statement.

APRs vary by tier, minimum payment defaults to 5 percent or AED 100, and the interest-free period runs up to 55 days when statements are paid in full on time.

Foreign currency fees and cash advance fees apply, and visa-run spending or cash-like transactions may be excluded from rewards. Applicants seeking higher limits over time should use the card regularly, keep utilization modest, and maintain on-time payments for six straight months.

App Setup and First-Time Use

Activation completes in-app for virtual credentials, while the physical card follows standard delivery timelines.

Adding the card to mobile wallets enables contactless payments immediately where accepted, and category alerts help monitor spend against monthly caps. Reward switching between cashback and miles happens in settings without replacing the card, which reduces downtime.

Because Emirates NBD is moving toward stronger in-app verification, expect more approvals to occur through the phone rather than SMS OTP over time.

Troubleshooting

Approval pending screens often indicate manual verification for identity, employment, or affordability checks, especially when income sources vary. Recheck document clarity and exact name order if the review extends beyond a day.

Card not received issues usually resolve through address confirmation and re-dispatch, while immediate declines related to risk controls can require paying down other obligations to lower the debt burden ratio.

Reward posting anomalies typically resolve on the next statement cycle; however, large partner offers may take longer depending on the merchant’s settlement process.

Conclusion

For a digital-first setup that prioritizes quick onboarding, flat-rate earning, and lifestyle value, the Liv Bank Credit Card keeps the application tight and the ongoing management even tighter.

Salary-based applicants who meet age, income, and risk controls generally move fastest, while the deposit-secured path offers responsible access when payroll doesn’t fit.

Keeping utilization reasonable, payments punctual, and reward settings aligned to monthly plans helps capture the most value across cashback and miles. An in-app workflow plus evolving authentication makes the overall experience efficient for daily use.