Frequent supermarket trips become more rewarding when spending turns into trackable, instant-value credits.

Searchers comparing a Nationwide Credit Card App experience to UK retail cards will find similar controls in the Asda Money Credit Card app, including real-time alerts and Cashpot transfers.

Availability is limited to UK residents aged 18 or over, but many U.S. readers still benchmark features, rates, and app tools against local cards.

What the ASDA Money Cashback Card Is

This is a UK store-linked credit card that returns a portion of everyday spend as Asda Pounds, collected in a Cashpot and redeemable at Asda.

The card has no annual fee, a representative 27.9% APR (variable) with an assumed £1,200 limit, and standard eligibility rules: status checks, 18+ age, and UK residency.

Issuing is by Jaja Finance Limited, while Asda Stores Limited acts as credit broker not a lender under FCA permissions.

Everyday Cashback Rates and Where They Apply

Cardholders earn 0.75% back at Asda, including groceries, George clothing, Asda petrol, Asda Opticians, Asda Mobile, and Asda Tyres.

General spend outside Asda earns 0.2% back. Exclusions include cash, cash alternatives, and purchases at Asda Travel Money bureaus or online.

Earned Asda Pounds appear in the credit card app or online servicing shortly after qualifying transactions.

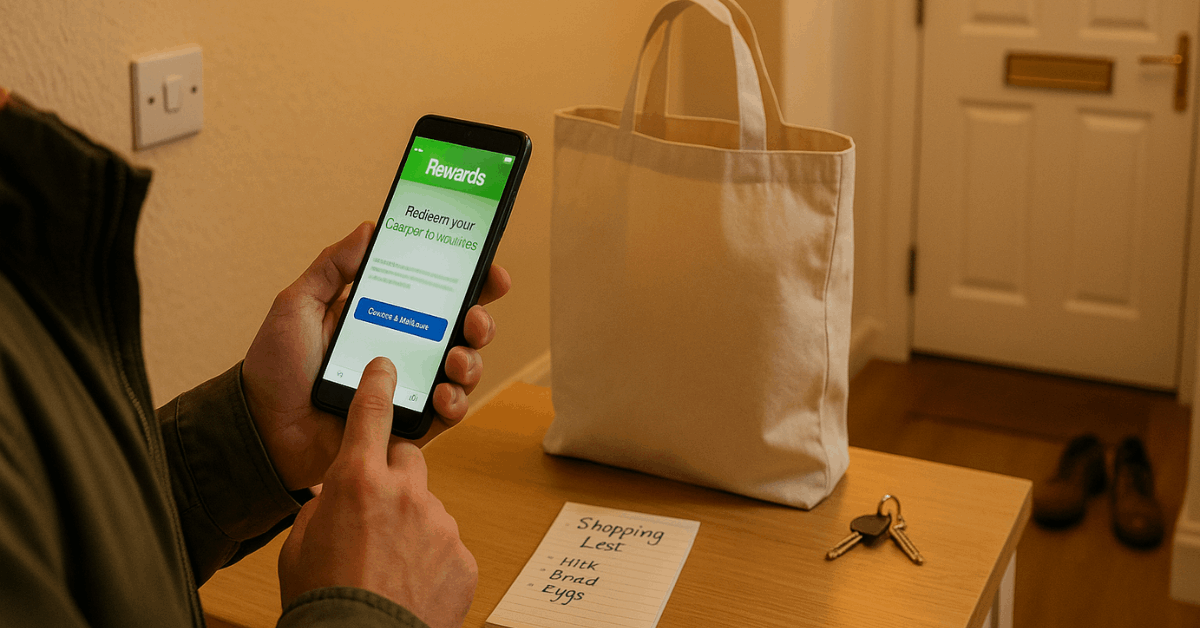

How Asda Pounds and the Rewards App Work

Asda Pounds move into an Asda Rewards Cashpot, which converts to vouchers for in-store or online redemption in defined increments and expiry windows controlled by Rewards terms.

Transfers from the credit card app into the Cashpot happen in a few taps, and vouchers are then generated in the Rewards app.

Travel Insurance purchased with the card currently yields 10% back in Asda Pounds while the offer runs, including auto-renewals.

Eligibility and Required Documents

Applicants must be 18+, UK-resident, and pass credit checks. A short online eligibility checker estimates likely acceptance and an indicative rate/limit using a soft credit check eligibility process that doesn’t impact your credit rating.

Prepare recent address history (three years), income, and ongoing commitments before submitting a full application.

Apply Online in Minutes

Establish a smooth path from pre-check to activation by following concise steps. Expect most decisions to be made quickly, with occasional referrals for manual review.

- Use the eligibility checker first to avoid unnecessary hard footprints on your file.

- Create or sign in to an Asda.com account when prompted during the application.

- Enter personal details, three-year address history, income, and employment information accurately.

- Review the Summary Box, indicative APR, and limit; submit for a lending decision.

- On approval, activate the card via the app and set up Direct Debit inside online servicing.

Rates, Limits, and Fees

The representative 27.9% APR (variable) reflects typical pricing for part of the approved population and can vary by profile.

Interest rates for purchases, balance transfers, and cash advances move in line with the Bank of England base rate.

The card charges no annual fee; cash-like transactions don’t earn rewards and typically cost more. An assumed credit limit of £1,200 appears in the representative example.

Managing the Account in the App

Real-time spend notifications support budgeting and fraud awareness.

The app allows card freezing, unfreezing, one-off payments, Direct Debit management, and immediate visibility of earned Asda Pounds for Asda Rewards Cashpot transfer.

Feature depth mirrors expectations set by a Nationwide Credit Card App experience: quick controls, balance views, and on-device security.

Security, Wallets, and Payments

This card supports contactless mobile wallets, Apple Pay, and Google Pay, for in-store, in-app, and web payments.

Adding the card is streamlined within the credit card app or through the native Apple Wallet and Google Wallet flows, using a one-time passcode for verification.

Transaction alerts, card freeze controls, and standard Visa acceptance further strengthen the day-to-day security posture.

Who Should Consider This Card

Regular Asda shoppers seeking automatic, simple-to-track value gain most from the 0.75% in-Asda earn rate.

General spend at 0.2% is convenient but may be outperformed elsewhere; pairing with a stronger non-supermarket card can improve blended returns.

Consider total value with promotions—in some periods, a Cashpot sign-up bonus has been offered for new customers, while recognizing that promotional terms change and can be withdrawn.

Alternatives and Pairing Strategies

The Asda Money Select Credit Card targets applicants building or rebuilding credit, using a higher representative APR (34.9% variable) and different acceptance criteria.

Another option, the Asda Money Balance Transfer Card, offers 0% balance transfer for 6 months with a 3% fee (minimum £3) and earns rewards on new spend; consider this if consolidating existing balances is a priority.

Combine the Cashback Card for Asda purchases with a higher flat-rate card elsewhere to optimize net rewards while keeping management simple through a single retailer ecosystem.

Tips to Maximise Rewards and Save

Clear habits keep rewards growing while minimizing borrowing costs. Small tweaks in usage patterns typically make the biggest difference.

- Funnel groceries, George, petrol, and opticians’ spend to capture 0.75% earn.

- Redeem Cashpot vouchers alongside in-store promotions for stronger total savings.

- Avoid cash and cash-like transactions because they don’t earn and often cost more.

- Set a Direct Debit for the full balance to prevent interest and late fees.

- Consider pairing for non-Asda spend if the 0.2% rate isn’t competitive in your wallet.

FAQs

More information about ASDA through questions:

- Is the card available to U.S. residents? No. Eligibility currently requires UK residency and age 18+. U.S. readers can use this structure as a comparison point when evaluating domestic supermarket cards.

- How fast do Asda Pounds appear? Rewards are posted after qualifying transactions and become visible in the credit card app or online services. Conversion to Cashpot and voucher issuance occur through the Asda Rewards app.

- Does Asda Travel Insurance pay extra with this card? Paying for Asda Travel Insurance with the card currently returns 10% in Asda Pounds, including auto-renewals, while the offer is live. Offers can change; always check current terms.

Support and Contact

Account help routes prioritize in-app chat and the online help centre.

Additional support is available by phone via the official Contact Us page, which currently lists assistance paths including Live Chat and a helpline; lost-and-stolen workflows are accessible directly from the app.

For complaint procedures and accessibility options, refer to Help and Support.

Conclusion

Supermarket-linked cashback remains straightforward here: 0.75% across the Asda ecosystem and 0.2% on general spend, with no annual fee and app-level controls that streamline daily use.

Strongest value arrives when most weekly shop categories, groceries, clothing, fuel, and services, naturally sit within Asda, while disciplined repayment prevents interest from eroding savings.

Applicants should confirm current promotions, review the Summary Box, and verify personal eligibility before applying.